In today’s fast-paced healthcare environment, managing finances effectively is crucial for maintaining a smooth operation in medical offices. From ensuring employees get paid on time to keeping track of financial records for tax purposes, proper record-keeping can make or break the success of a practice. One essential tool that can help streamline this process is a check stub maker.

A check stub maker is a simple but effective tool that helps medical offices generate accurate, detailed, and easily accessible check stubs for payroll purposes. By digitizing the payroll process, check stub makers reduce the likelihood of errors, save time, and promote efficient financial management. But why exactly should medical offices use check stub makers? Let’s dive deeper into the benefits and explore why this tool is a game-changer for practices across the country.

What Is a Check Stub Maker?

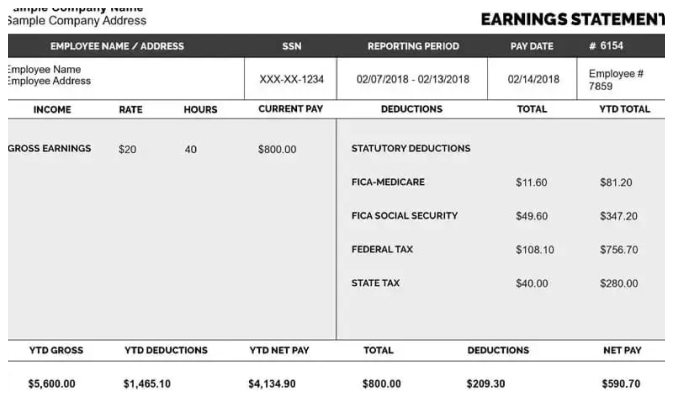

Before we delve into the advantages, let’s first understand what a check stub maker is. A check stub maker is a software or online tool that helps create professional, customizable check stubs. These stubs provide detailed information about an employee’s earnings, deductions, and net pay. In other words, they break down the components of an employee’s paycheck, making it clear how their pay is calculated.

Check stub makers often come with templates where you can input basic information, such as:

- Employee name

- Pay period dates

- Gross income

- Deductions (taxes, insurance, retirement contributions, etc.)

- Net pay

The check stub maker then generates a check stub in a PDF or printable format, which can be handed out to employees or stored electronically.

Now, let’s look at why medical offices should consider incorporating a check stub maker into their payroll and financial management processes.

1. Simplified Payroll Management

Medical offices often have a diverse team consisting of doctors, nurses, medical assistants, office staff, and other personnel. With such a varied workforce, calculating and issuing paychecks can become complicated. A check stub maker simplifies this process significantly.

Instead of manually creating pay stubs for each employee, which can be both time-consuming and error-prone, a check stub maker automatically generates the necessary documents with just a few clicks. This means the payroll team can focus more on other important tasks, such as ensuring accurate hours worked and handling other HR-related duties.

By automating paycheck generation, a check stub maker makes payroll management more straightforward, reducing the chance of costly errors and freeing up time for other critical office functions.

2. Increased Accuracy

One of the biggest advantages of using a check stub maker is the accuracy it provides. Payroll involves many calculations: gross pay, tax deductions, benefits, and other contributions. Mistakes in these calculations can lead to overpayments, underpayments, or even compliance issues with the IRS.

Manual payroll calculations leave room for human error, but a check stub maker helps eliminate this risk by automating the process. Once the necessary information is entered, the system does the calculations for you, ensuring the final pay stub is accurate and precise every time.

Moreover, the check stub maker can track past pay periods, so you can always reference previous pay stubs if needed. This level of accuracy is especially crucial in a medical office where employees often deal with different pay structures and variable hours.

3. Time Savings

In a medical office, time is valuable. Whether it’s coordinating patient appointments or managing patient records, there is no shortage of important tasks. Payroll should not be an overly time-consuming process, and using a check stub maker can help reduce the time spent on paycheck preparation.

Instead of manually creating pay stubs, inputting data, and printing individual checks, medical offices can generate all the pay stubs for their employees within minutes. Some check stub makers also offer features that allow for batch generation, meaning the payroll team can quickly generate pay stubs for the entire office workforce in one go.

This time-saving feature allows office staff to focus on more strategic activities, like improving patient care, managing insurance claims, or handling other operational concerns.

4. Compliance with Tax Laws

Medical offices are required to follow strict payroll tax laws and regulations, which can vary from state to state. Missteps in payroll can result in hefty fines, penalties, and even legal trouble. Fortunately, a check stub maker can help medical offices stay compliant with tax regulations.

Check stub makers often include built-in tax calculation tools that automatically apply federal, state, and local tax rates to employee earnings. This ensures that all necessary deductions are made and that the pay stubs reflect the correct amounts for taxes, Social Security, Medicare, and other required contributions.

Furthermore, many check stub makers are updated regularly to reflect changes in tax laws, which means medical offices don’t need to worry about keeping up with the latest regulations. The software will automatically update the calculations, ensuring compliance at all times.

5. Cost-Effective Solution

For many small to mid-sized medical offices, the cost of hiring a full-time payroll manager or outsourcing payroll services can be a significant expense. A free check stub maker offers a much more affordable alternative.

Most check stub maker software comes with an affordable subscription fee or a one-time payment, making it accessible for practices of all sizes. The money saved from not having to hire a dedicated payroll department or pay for expensive payroll services can be better invested in other areas of the practice, such as improving patient care or purchasing new medical equipment.

The efficiency and cost savings of using a check stub maker make it a worthwhile investment for medical offices looking to streamline their operations without sacrificing quality.

6. Improved Record-Keeping

Proper record-keeping is crucial for any medical office, both for internal purposes and in the event of an audit. With a check stub maker, medical offices can keep a digital record of all pay stubs, which makes it easy to retrieve important financial information when needed.

Digital records are much easier to store and search through than paper records, and they take up less physical space in the office. Many check stub makers also offer cloud storage, meaning that medical offices can store their records securely online, accessible from any device with an internet connection.

This feature not only improves record-keeping but also makes it easier to manage and track employee compensation over time, which can be helpful when preparing for tax season or conducting internal audits.

7. Customizable Pay Stubs

Every medical office has different payroll requirements, and a check stub maker allows for customization to fit the specific needs of the practice. Most check stub makers offer customizable templates, allowing medical offices to add specific categories such as bonuses, overtime pay, or reimbursed expenses. This ensures that each employee’s pay stub accurately reflects their individual pay structure.

Customization also means that medical offices can add their branding (such as logos and office contact information) to the check stubs, ensuring a professional and consistent appearance for all pay-related documents.

8. Employee Satisfaction

Finally, using a check stub maker can improve employee satisfaction. Employees expect to receive clear and transparent information about their pay, including a breakdown of how their earnings were calculated. Providing them with detailed, accurate check stubs through a check stub maker helps build trust and ensures they feel valued and informed.

Additionally, many check stub makers allow employees to access their pay stubs online, which means they can easily view or download them whenever needed. This accessibility adds convenience for employees and can improve overall morale within the office.

Conclusion

In today’s complex and highly regulated healthcare industry, managing payroll and financial records accurately is essential. Using a check stub maker can help medical offices streamline their payroll processes, improve accuracy, save time, ensure tax compliance, and provide greater transparency to employees. With a check stub maker, medical offices can focus on what matters: providing exceptional care to their patients, while keeping financial operations running smoothly and efficiently.

The benefits of using a check stub maker go beyond just simplifying payroll—it’s about making sure the financial side of the practice is running as efficiently as the healthcare side. By integrating this tool into your office’s operations, you can save time, reduce errors, and provide employees with the accurate information they need, all while maintaining compliance with tax regulations. It’s a win-win solution for everyone involved!